| StockFetcher Forums · Stock Picks and Trading · 2019 Watch list | << >>Post Follow-up |

| Eman93 4,750 posts msg #145727 - Ignore Eman93 |

12/27/2018 10:03:00 AM Pick 5 stocks or ETF's you think will be winners. Gold and Silver are looking good, I have some PSLV and added to it yesterday Amazon is always the monster in the room, if it comes down to 1000 that would be a 50% retrace Pandora at 5. Pot stocks have pulled back anyone know of a good one? SPY at 213 |

| Mactheriverrat 3,178 posts msg #145769 - Ignore Mactheriverrat |

12/30/2018 5:00:01 AM Hard to say with Markets in a Bearish mood. If they do turn Bullish there will be great setups again.  |

| four 5,087 posts msg #145770 - Ignore four modified |

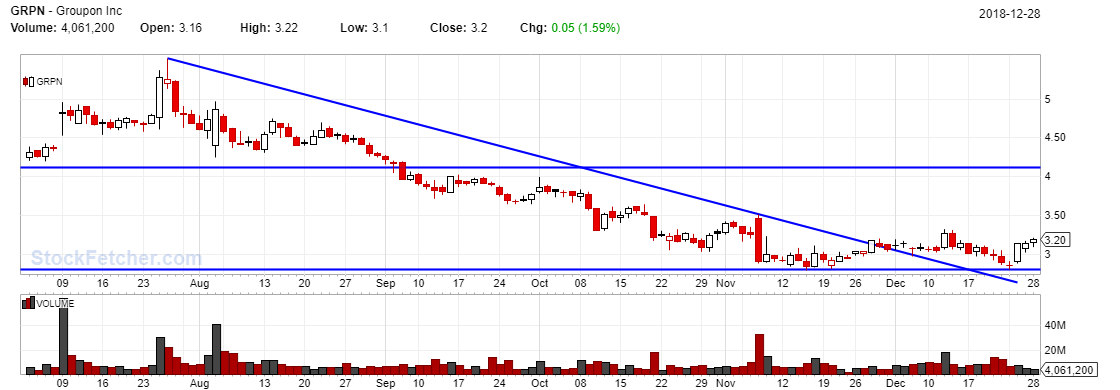

12/30/2018 12:42:58 PM Mac, would you consider these lines?  |

| Mactheriverrat 3,178 posts msg #145777 - Ignore Mactheriverrat modified |

12/30/2018 4:32:31 PM Yes but I use the latest last 2 highs from that downtrend. Like in Guppy. MEET broke downtrend 2 days ago is a prime example.  /* When the EMA8 cross's the EMA21. Draw your downtrend resistane lines. If price breaks above downtrend line, chance's are it will be a breakout. Also watch out for higer volume as other trader,s buy in too. Bullish! Keep it plain and simple. */ Still studying KSK8 faster cross code but staying with the EMA8 cross the EMA21 for now. Then again things all always subject to change. I did a quick study of EMA8 cross the EMA21 on S&P 500 stocks The cross and use of downtrend resistance line's to look for stock which might be on the verge of a Breakout. |

| sammyn 81 posts msg #145799 - Ignore sammyn modified |

12/31/2018 4:16:29 PM a)Sector has been basing b)Sector 30 week MA is rising, and sector is outperforming S&P. c)Stock has to be in the sector d)Stock is breaking out of a base e)Stock 30 week MA is rising. Not married to any names, just criteria. |

| Mactheriverrat 3,178 posts msg #145800 - Ignore Mactheriverrat |

12/31/2018 5:03:46 PM MEET up on above average volume.  |

| StockFetcher Forums · Stock Picks and Trading · 2019 Watch list | << >>Post Follow-up |