| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 25 26 27 28 29 ... 48 >>Post Follow-up |

| sandjco 648 posts msg #142127 - Ignore sandjco |

2/11/2018 5:27:25 PM I know what you mean pt...however, the strange thing is that I NEVER ever saw it hit the $70's...i was happy it hit the $90's and then boom...the next day it imploded! it was almost like a few big hedge funds cornered it enough to trigger the expected action from CS. |

| sandjco 648 posts msg #142175 - Ignore sandjco |

2/13/2018 8:41:50 AM Bought SCIF using EOD $64.90 and GASL $17.89   |

| sandjco 648 posts msg #142214 - Ignore sandjco |

2/14/2018 9:07:39 AM Eerrieee....almost like ppl are waiting for the other shoe to drop or expecting this bounce to pitter out or waiting for the next set up to align... If one "trades"; what happens next shouldn't really matter no? it would then be a matter of playing the "swings" to meet one's profit/risk tolerances. For B&Holders, it was a chance to dollar cost average at a discounted price from the recent highs.     probably won't get much action till the next earnings season... |

| four 5,087 posts msg #142221 - Ignore four |

2/14/2018 10:08:26 AM https://investorplace.com/2018/02/how-long-will-this-market-volatility-persist/ |

| sandjco 648 posts msg #142241 - Ignore sandjco |

2/14/2018 6:09:14 PM LMAO....who let the dawgs out????      I think I'm kinda liking the leverage from options; not that I know anything about it. Like a blind squirrel who found a nut...AMZN, BABA, and NFLX calls just went nuts! |

| sandjco 648 posts msg #142248 - Ignore sandjco |

2/14/2018 9:23:02 PM @four...thank you for sharing the link. looks like the dip was "bought".... |

| sandjco 648 posts msg #142251 - Ignore sandjco |

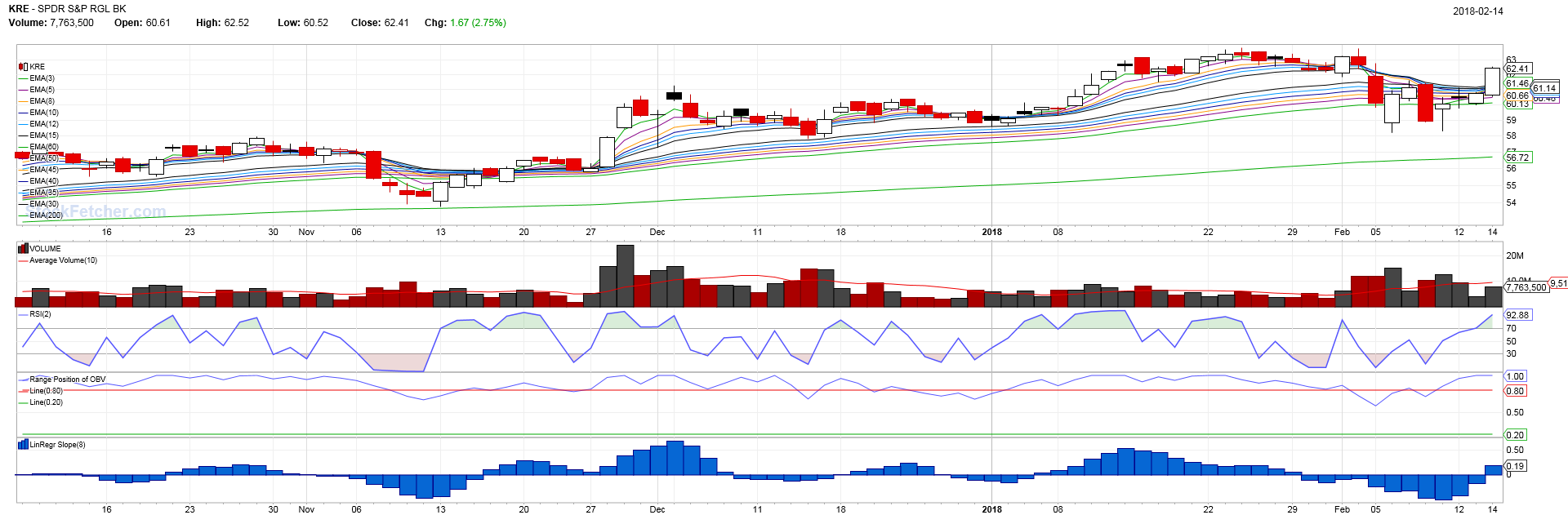

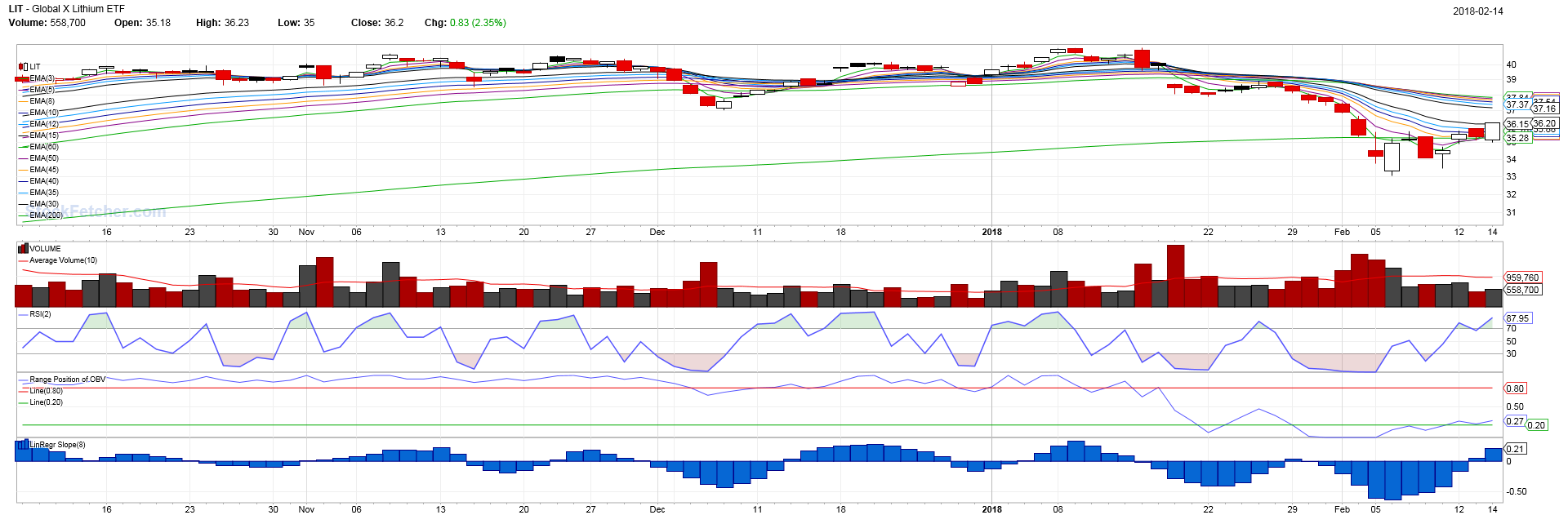

2/15/2018 7:20:54 AM  |

| four 5,087 posts msg #142255 - Ignore four |

2/15/2018 11:19:44 AM welcome keep trading! |

| sandjco 648 posts msg #142261 - Ignore sandjco modified |

2/15/2018 3:41:45 PM @four...sometimes I think I am over thinking about things! Options are addicting! Do you know of any free online calculator that would tell you what the approximate jump in option price would be vis a vis a gain in the stocks' share price? I don't know how to tell if an option price is cheap or expensive relative to the share price. I mean, none of that mattered when I picked up a bunch of OSTK, NFLX, AMZN, or even EEM. SPOO crossed up EMA50; don't think we will re-test the high (I wanna be wrong)...big boys may dump in order to remount. Here is where I get confused....take the profits or risk losing some of it by waiting for a "signal". I know....it is a "ME" problem. ;=P Thanks for the encouragement; not sure if it is luck or skill! Sold EUXL and may sell the remaining ETFs and AMZN.... |

| sandjco 648 posts msg #142294 - Ignore sandjco |

2/16/2018 6:06:16 PM Mostly in cash. Tested a small position on SPY Call option. Kept GASL. Happy with KORU 17%, NFLX 8% and TQQQ 10%. Rest had minimal gain/loss for a wash. Does anyone know what a good replacement is for XIV and shorting VXX? |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 25 26 27 28 29 ... 48 >>Post Follow-up |